How to File 1099-MISC Forms

Once you have used WP1099 to export all of the payout information during the year, you will need to fill in some information for each recipient.

Add required information

The file you export from WP1099 can be edited with software like Microsoft Excel, Apple Numbers, OpenOffice Calc, Google Sheets, and others.

Once you open this export file, you can fill in the missing information including:

- Recipient's address.

- Recipient's taxpayer ID number.

- Recipient's name will be filled in from their name as it is listed on your site. However, the IRS is very particular and the name given should match the name they provide you on their W9 form. Edit this name if necessary.

After you have completed this information, save the file.

For more information on why WP1099 does not collect or store this information, please see this support document.

What are Different of 1099-MISC Copies Used For?

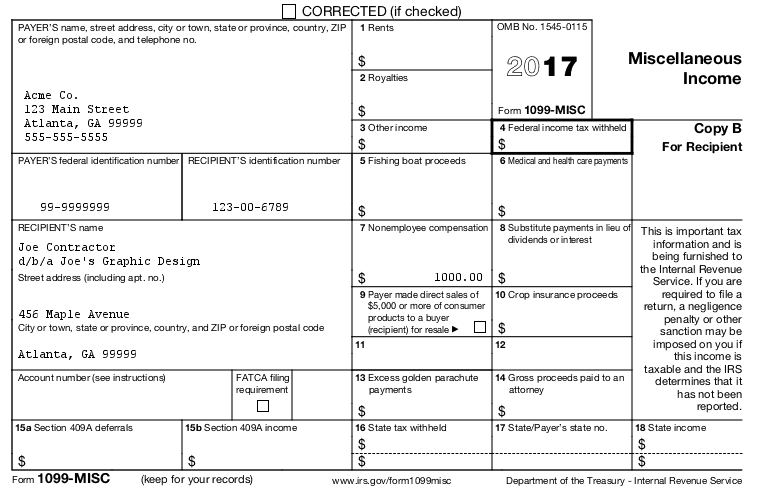

There are five copies of the 1099-MISC form that need to be filed. To identify which copy is which, look at the far right column under the words "Miscellaneous Income". The copies are Copy A, Copy 1, Copy B, Copy 2, and Copy C. The copies with a letter are for federal filing, and the numbered copies are for state filing.

- Copy A: This is the only copy that is printed in red. As a business, this is the copy that gets sent to the IRS. If you are e-filing you may never actually see this copy. Paper filers require a special, scannable version of this form that must be obtained in order to file. Do not attempt to file a copy that you print off of the IRS' website. To order the scannable copies of 1099-MISC, visit https://www.irs.gov/orderforms. Then click on Employer and Information Returns and follow the instructions.

- Copy 1: This is the copy that you, as a business, would send to your state's taxation department. Some states do not require 1099-MISC forms at all, and some require it only under certain circumstances. If you are e-filing, the IRS may be able to file this for you if your state participates in the Combined Federal/State Filing Program. If your state does not participate in this program, you will need to check with the state's taxation department to see how they want you to file.

- Copy B: This is sent to your recipient. They will use it to assist in filing their federal income taxes and retain it for their records.

- Copy 2: This is also sent to your recipient. They will use this to file their state income taxes if their state requires it.

- Copy C: This copy is for you as the business to retain for your own records.

Here is an example of a completed 1099-MISC form.

The same information should be provided on each copy of the form. When your recipient files their income taxes, they will include the information provided on the 1099-MISC form. When the IRS receives the recipient's income tax return, they will compare the amounts on Copy A that you filed with them to the amounts found on the recipient's return. If there are any discrepancies, it will trigger a red flag at the IRS and cause issues for the recipient, and you.

How to file?

As described above, the IRS will require a copy to be filed with them, your state may also require a copy, and your recipient will need their copies.

The easiest way to file will be to e-file, which requires a special software. To do this, you have three options:

- A local accountant. Most local accountants will already have the software required to file 1099-MISC forms on your behalf. They may charge a small fee per form to do this.

- An online filing service. Our export file works well with online filing services like tax1099.com. After completing the missing information from the export file, you can simply upload the CSV file to one of these services and they'll handle the filing for you. There is even an option with some of the services like tax1099.com to have the 1099-MISC forms mailed to your recipients. There is a small fee to have an online service file these forms for you.

- Do it yourself. This option is not usually recommended. It requires an account with the IRS, which requires a Transmitter Control Code (TCC) from the IRS. This can be obtained by filling out form 4419, and must be submitted at least 45 days before the filing deadline. Once you receive your TCC, you will need to create an account on the IRS Filing Information Returns Electronically (FIRE) system. The FIRE system requires special software that creates the file you upload in the proper format for the system to read. Unless you have e-filed 1099-MISC forms in the past, it is usually more cost effective, and less error prone to go with options 1 or 2 above.

If you e-file, you will still be responsible for sending Copy B and Copy 2 to your recipients, and Copy 1 to your state if it requires it and does not participate in the Combined Federal/State Filing Program.